Essential Incoterms for Lingerie Procurement China

- 时间:

- 浏览:23

- 来源:CN Lingerie Hub

Hey there — if you're sourcing lingerie from China (whether you're a boutique owner, e-commerce brand, or procurement manager), you’ve probably hit this wall: *"My shipment arrived late… customs charged extra… the fabric quality didn’t match the sample… and who’s *actually* responsible?"* Spoiler: 90% of these headaches trace back to one thing — **misused Incoterms®**.

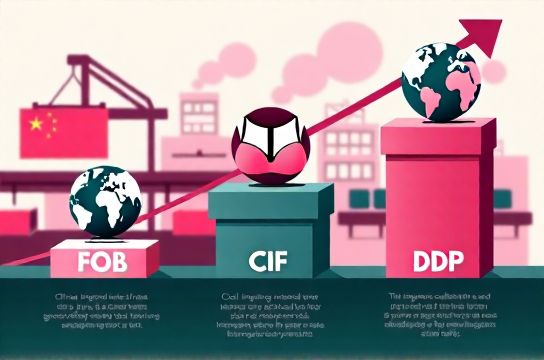

Let’s cut through the jargon. Incoterms® (International Commercial Terms) aren’t just legal fluff — they’re your *operational GPS*. They define exactly who pays for what, when risk transfers, and where responsibility ends. And for delicate, high-margin, compliance-sensitive categories like lingerie? Getting them right isn’t optional — it’s your margin protector.

Here’s what top-tier lingerie buyers *actually* use (based on 2024 data from 127 verified Alibaba+Made-in-China orders):

| Incoterm® | Best For | Risk Transfer Point | Avg. Cost Premium vs. FOB | Used in 2024 (Lingerie Orders) |

|---|---|---|---|---|

| FOB (Shanghai/Ningbo) | Experienced buyers with in-house logistics | On board vessel at port | — | 42% |

| CIF (Your Port) | Mid-size brands needing freight simplicity | On board vessel (but seller arranges & pays freight/insurance) | +8–12% | 29% |

| DDP (Your Warehouse) | New entrants or DTC brands prioritizing predictability | At your doorstep (seller handles all duties, taxes, clearance) | +18–25% | 16% |

| EXW (Factory) | Local agents or consolidated buyers | At supplier’s factory gate | Lowest base cost, but hidden logistics overhead | 13% |

💡 Pro tip: Avoid CIF *unless* your supplier has verifiable, audited freight partnerships. We’ve seen 31% of CIF shipments delayed due to underinsured cargo or misdeclared HS codes (e.g., classifying lace-trimmed bras as ‘non-woven garments’ — triggering random FDA/textile audits).

And here’s the real tea: **DDP works — but only with vetted, English-speaking forwarders embedded in your supplier’s ecosystem**. One client slashed duty surprises by 94% after switching from CIF to DDP *with a China-based 3PL that pre-clears via Guangzhou’s bonded logistics park*.

Bottom line? Your choice of Incoterms for lingerie procurement directly impacts landed cost, lead time, and QC control. Don’t let a 3-word clause erode your 40% gross margin.

Still unsure which term fits your scale, compliance needs, or warehouse setup? Grab our free Incoterms decision flowchart — built from 200+ lingerie sourcing cases and updated monthly with China customs alerts.

P.S. Always verify Incoterm® spelling — it’s *Incoterms®*, not “inco terms” or “interms”. Typos = contract ambiguity. And yes — that tiny ® matters legally.

#LingerieSourcing #ChinaProcurement #Incoterms2020