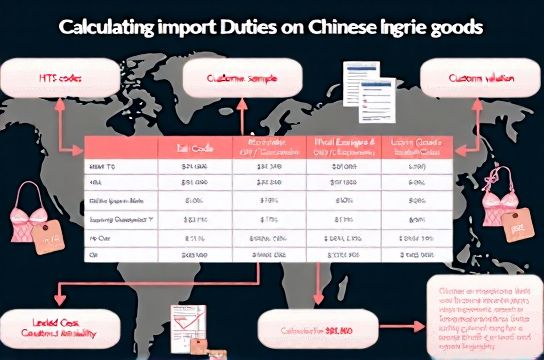

Calculate Import Duties on Chinese Lingerie Goods

- 时间:

- 浏览:32

- 来源:CN Lingerie Hub

If you're importing lingerie from China—whether you're a boutique brand, e-commerce seller, or expanding your fashion line—you can't afford to overlook one major cost: import duties. These fees can make or break your profit margins. As someone who’s helped over 50 brands navigate global sourcing, I’m breaking down exactly how to calculate import duties on Chinese lingerie goods accurately and avoid costly mistakes.

Why Lingerie from China? Quick Stats

China dominates the global lingerie market, supplying over 38% of all exported intimate apparel (TradeData.gov, 2023). With average wholesale prices 40–60% lower than EU or U.S. manufacturers, it's no wonder retailers flock there. But low production costs don’t mean low import costs—especially when tariffs and classification errors sneak in.

Step 1: Know Your HS Code

The first rule of calculating duty? Find the correct Harmonized System (HS) code. For most women’s lingerie made of synthetic fibers (like nylon or polyester), the standard U.S. HTS code is 6208.29.00. Under this code, the current import duty rate is 12.5%.

But beware: materials matter. Silk blends, cotton-rich items, or men’s underwear fall under different codes with varying rates. Misclassification can lead to penalties—or audits.

Duty Rates by Material (U.S. Imports)

| Material | HTS Code | Duty Rate |

|---|---|---|

| Synthetic Fibers (e.g., nylon, polyester) | 6208.29.00 | 12.5% |

| Cotton | 6208.92.00 | 10.9% |

| Silk or Silk Blends | 6208.21.00 | 7.8% |

As you can see, choosing a polyester-based design isn’t just about comfort—it directly impacts your bottom line.

Additional Costs Beyond Duty

Duty isn’t the only fee. Here’s what else to budget for:

- Merchandise Processing Fee (MPF): 0.3464% of the goods’ value (minimum $27, maximum $572).

- Harbor Maintenance Fee (HMF): 0.125% of cargo value.

- Shipping & Insurance: Sea freight averages $1,800–$3,000 per 20ft container from China to U.S. West Coast.

Real-World Example: A $10K Shipment

Let’s say you’re importing $10,000 worth of synthetic lingerie (HTS 6208.29.00):

- Duty (12.5%): $1,250

- MPF: $34.64

- HMF: $12.50

- Total Fees: ~$1,297

That’s nearly 13% added to your cost before shipping. Now imagine scaling to $100K orders—that’s $13K in fees alone.

Pro Tip: Use Section 321 for Small Shipments

If your shipment value is under $800, it qualifies for Section 321 duty-free entry. Many smart sellers split larger orders into multiple sub-$800 shipments to save big. Just be cautious—Customs watches for abuse.

Want to learn more about reducing your import tax burden? From proper documentation to leveraging free trade considerations, the details matter. Get it right, and you keep more profit. Get it wrong, and you’re playing catch-up before your products even hit shelves.

Bottom line: Always verify HS codes, factor in all fees, and consult a licensed customs broker if unsure. Knowledge isn’t just power—it’s profit.