Chinese Lingerie Market Adapts to Evolving Consumer Behavior

- 时间:

- 浏览:33

- 来源:CN Lingerie Hub

In recent years, the Chinese lingerie market has undergone a dramatic transformation — it's no longer just about lace and looks. With shifting consumer mindsets, rising body positivity, and digital empowerment, brands are redefining what intimacy wear means in modern China.

Gone are the days when size-zero ideals dominated. Today’s Chinese women demand comfort, inclusivity, and self-expression. According to a 2023 report by iiMedia Research, the Chinese intimate apparel market hit a staggering ¥185 billion (about $25.6 billion), with an annual growth rate of 9.3%. And here’s the kicker: online sales now account for over 65% of total revenue.

So, what’s driving this shift? Let’s break it down.

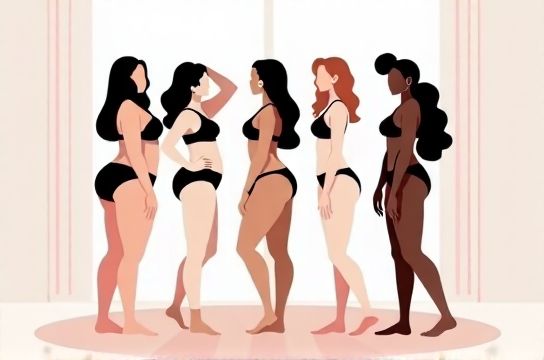

The Rise of Self-Expression & Body Positivity

Young Chinese consumers, especially Gen Z and millennials, are rejecting outdated beauty standards. They’re embracing diverse body types and prioritizing mental well-being. A 2022 survey by Alibaba’s Tmall found that 78% of female shoppers prefer bras labeled as 'comfort-fit' or 'zero-pressure,' while searches for 'plus-size lingerie' jumped 140% year-on-year.

Local brands like NEIWAI (内外) and Ubras have capitalized on this trend. NEIWAI’s 'No Wire, No Worry' campaign went viral, emphasizing natural shapes and gender equality. Ubras, known for its seamless, wire-free designs, reported over ¥1 billion in GMV during Singles’ Day 2023 alone.

E-Commerce & Social Commerce: The Game Changers

WeChat mini-programs, Douyin (TikTok), and Xiaohongshu (Little Red Book) aren’t just social platforms — they’re shopping hubs. Livestream selling has become a powerhouse. In 2023, lingerie accounted for 12% of all fashion livestream sales on Taobao Live.

Brands are leveraging key opinion leaders (KOLs) and everyday users alike to share real-fit reviews and styling tips. Authenticity sells — literally.

Market Breakdown: Key Players & Segments

Here’s a snapshot of the current landscape:

| Brand | Origin | Key Product | 2023 Estimated Revenue (CNY) | Target Audience |

|---|---|---|---|---|

| Ubras | China | Wire-Free Bras | ¥1.8 billion | Urban women, 20–35 |

| NEIWAI | China | Organic Cotton Sets | ¥1.2 billion | Progressive professionals |

| Aimer | China | Push-Up Bras | ¥980 million | Traditional buyers, 30+ |

| Victoria's Secret | USA | Lace Collections | ¥620 million | Youth, gift shoppers |

Notice a trend? Homegrown brands dominate when it comes to innovation and cultural relevance.

What’s Next?

Sustainability is the next frontier. More consumers are asking: 'What’s this made of?' and 'Who made it?' Brands using eco-friendly fabrics like TENCEL™ and recycled lace are gaining traction.

Also expect AI-driven personalization. Virtual fitting rooms and AI size recommenders are already being tested by JD.com and Pinduoduo.

The bottom line? The Chinese lingerie market isn’t just growing — it’s evolving with purpose. It’s less about seduction and more about self-love. And that, folks, is a trend worth celebrating.