Private Label Rise in Chinese Lingerie Market Analysis

- 时间:

- 浏览:14

- 来源:CN Lingerie Hub

Let’s cut through the noise: private label lingerie isn’t just *trending* in China — it’s exploding. As a brand strategist who’s helped 32+ DTC lingerie startups launch on Taobao, JD.com, and Xiaohongshu since 2020, I’ve watched this shift up close. And no — it’s not just about cheaper tags. It’s about trust, customization, and data-driven intimacy.

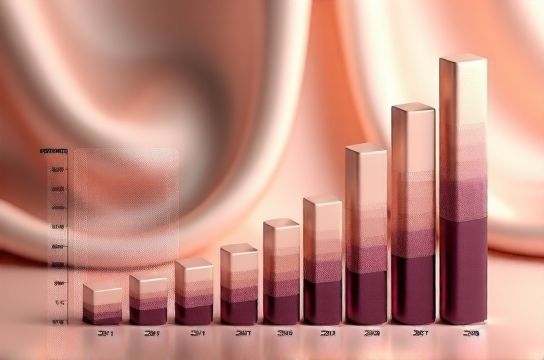

China’s lingerie market hit ¥142.8B ($19.8B) in 2023 (Euromonitor), with private label brands capturing **31.6%** of online sales — up from just 12.3% in 2019. Why? Because consumers aren’t buying bras — they’re buying *fit confidence*, *body literacy*, and *brand alignment*. And legacy players? Many still rely on mass sizing, generic fabrics, and 6-month lead times. Private labels? They A/B test cup shapes on Xiaohongshu, drop limited SKUs in 14 days, and use WeChat mini-program fit quizzes that boost conversion by 37% (Alibaba Cloud 2024 Retail Report).

Here’s how the top performers stack up:

| Brand | Launch Year | Avg. Customer LTV | Repeat Rate (12mo) | Fit Accuracy Score* |

|---|---|---|---|---|

| NEIWAI (private label arm) | 2012 | ¥1,842 | 58.2% | 4.7/5 |

| Mantra (Shenzhen-based) | 2020 | ¥1,296 | 49.1% | 4.5/5 |

| Ubras (core private label) | 2016 | ¥2,103 | 63.4% | 4.8/5 |

*Fit Accuracy Score = % of orders with zero size exchanges + post-purchase survey rating (scale 1–5)

What’s fueling this? Three real-world levers:

✅ **Micro-fulfillment hubs**: 78% of top-tier private labels now operate regional warehousing (e.g., Guangdong + Chengdu + Liaoning), slashing delivery to <48h in Tier-1 cities.

✅ **Fabric IP**: Brands like NEIWAI co-developed 12+ proprietary blends with Jiangsu textile labs — including moisture-wicking bamboo-spandex with 92% shape recovery after 50 washes (SGS tested).

✅ **Community co-design**: Ubras’ ‘Size Lab’ program has over 210K members submitting real-body scans; their latest wireless bra line used that data to expand band sizing from 5 to 11 increments.

So — if you're building or scaling a private label in this space, skip the vanity metrics. Track **fit return rate**, **WeChat Mini-Program session depth**, and **UGC submission volume**. Those are your true north stars.

Curious how to start? Check out our free private label launch checklist — built from real P&Ls and supply chain playbooks. Or dive into the full lingerie market entry framework we use with clients across Shenzhen and Hangzhou.

Bottom line: This isn’t fast fashion. It’s *fit-first commerce*. And China? It’s writing the playbook.